Which of the following is not a correct statement. School University of Missouri.

/dotdash_INV_final-Introduction-to-Inflation-Protected-Securities_Mar_2021-01-6c9fb72cb0d448d8ae2e68a37c58123c.jpg)

Introduction To Inflation Protected Securities

Which of the following are true about this security.

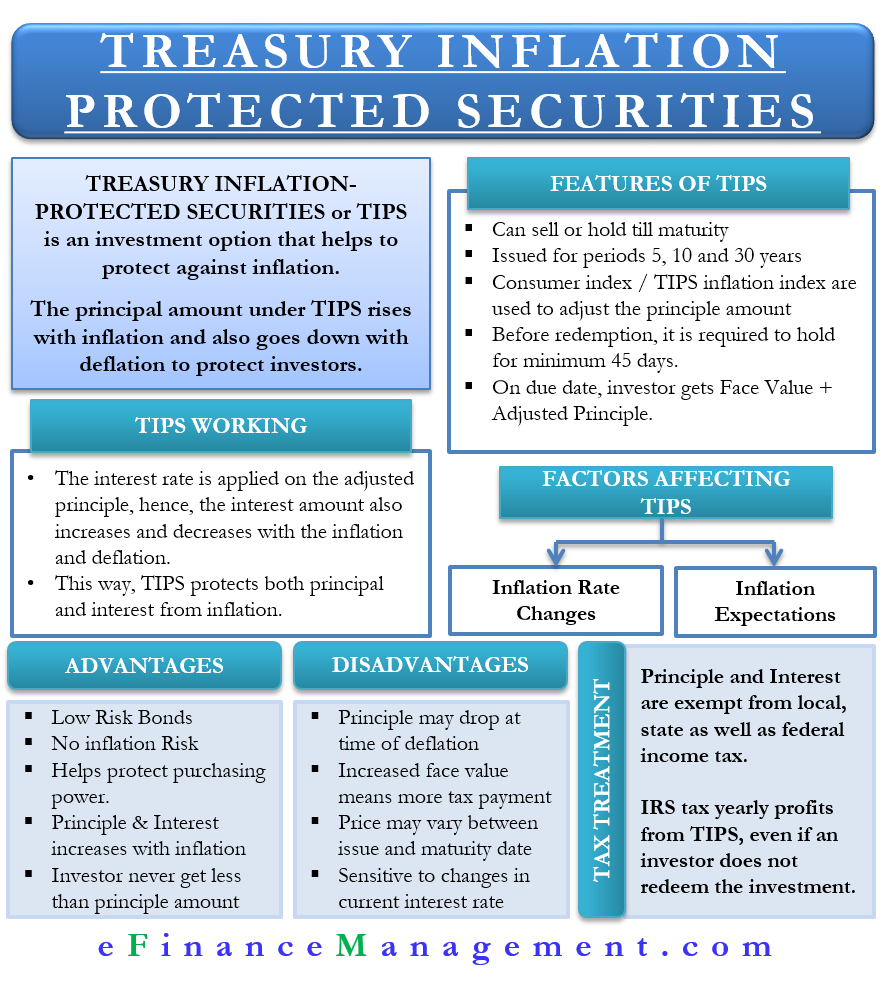

. Treasury inflation-protected securities can be easily understood with the help. With a rise in the index or inflation the principal increases. This is done by adjusting the face value of the bond.

TIPS pay interest every six months. Pages 5 This preview shows page 3 -. If the Treasury and corporate bonds have a par value of 1000 and the municipal bond has a par value of 5000 what is the price of these three bonds in dollars.

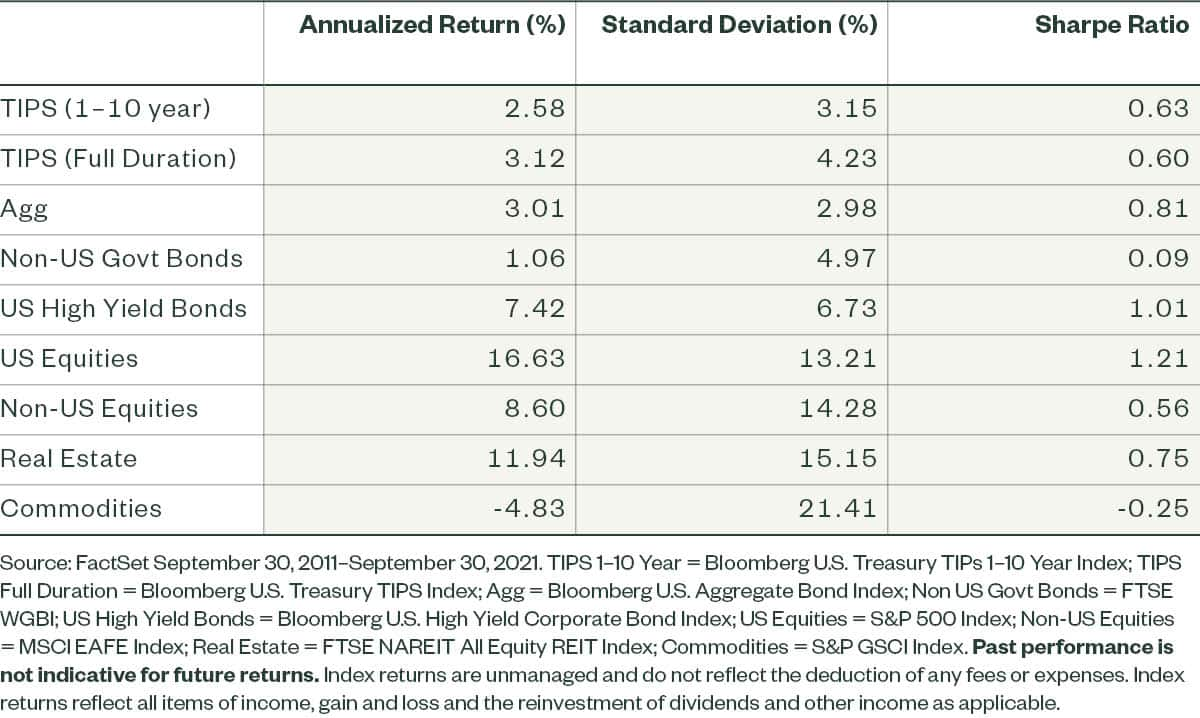

The real world. A relatively novel class of bonds Treasury Inflation-Protected Securities were introduced in the United States in 1997. Treasury inflation-protected securities pay out in two ways.

Consider the following three bond quotes. The principal of Treasury Inflation-Protected Securities also called TIPS is adjusted according to the Consumer Price Index. Which of the following issues Treasury Inflation Protected Securities TIPS.

Financial institutions and markets. For instance the 5-year TIPS Bonds maturing on 101526 pay interest at a. TIPS have suddenly moved to center stage for investors as the surge in inflation has drawn new interest in Treasury inflation-protected securities.

TIPS Market Overview and Mechanics. Treasury inflation-protected securities have fixed coupon rates. The basic notion behind their construction is to index the principal and income on a US.

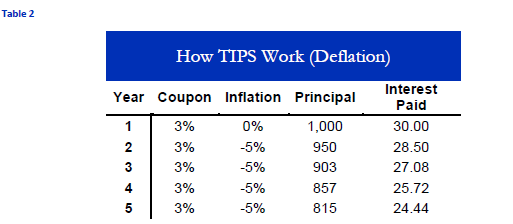

Which of the following issues treasury inflation. They can lose value when the CPI drops but never to the point where theyre worth less than their face value. Pay a variable interest rate that is indexed to inflation but maintain a constant principal.

Treasury security to inflation1 The US TIPS market is the worlds largest inflation- indexed securities market with a market value of over 187 trillion2 The Federal. The federal government adjusts the par value of Treasury inflation-protected securities at the rate of inflation. It makes no periodic interest payments and makes one lump sum payment at maturity.

Course Title PHYSCS 2750. A relatively novel class of bonds Treasury Inflation-Protected Securities were introduced in the United States in 1997. In the first year you receive 10 in interest 1 of 1000 split into two semiannual payments of 5 apiece.

Provide a constant stream of income in real. TIPS are unique because their principal and interest payments are indexed to the rate of inflation as measured by the Consumer Price Index. These bonds have been created in order to protect the investor against the impact of inflation.

The principal of a TIPS increases with inflation and decreases with deflation as measured by the Consumer Price Index. Which of the following issues Treasury Inflation Protected Securities TIPS A. In the second year of ownership you collect 1 of the.

Based on an increase in the consumer price index CPI and the yield above inflation. TIPS pay interest twice a year at a fixed rate. The investor decides about what kind of securities to own such as bonds or stock.

Expert solutions for 11Which of the following issues Treasury Inflation Protected Securities TIPS. Pages 26 This preview shows page 2 - 4 out of 26 pages. These facilitate cash flows between investors and companies.

Over the course of that first year inflation runs at 2. Which of the following issues treasury inflation. At maturity investor in Treasury inflation-protected securities receives an inflation-adjusted principal.

Course Title FIN 370. With a fall in the index or deflation the principal decreases. Investors invest in bonds and stocks in financial markets floated by companies.

So the face value the principal amount of your TIPS adjusts upward from 1000 to 1020 at the end of that year. In todays real world youll have to pay a premium for the inflation-protection privilege. The US TIPS market is the worlds largest inflation-indexed.

Treasury inflation-protected securities are special types of bonds which are issued by the United States government. But how much do investors really know about. 1- You purchase one or more Treasury Inflation-Protected Securities 2- You then earn a fixed interest rate on the TIPS bond you own 3- When inflation increases the bond principal increases 4- When deflation occurs the bond principal decreases.

When a TIPS matures you are paid the adjusted principal or original principal whichever is greater. The basic notion behind their construction is to index the principal and income on a US Treasury security to inflation. Treasury Inflation-Protected Securities TIPS are a type of notes and bonds issued by the US.

Treasury Inflation-Protected Securities or TIPS provide protection against inflation. Therefore TIPS provide explicit inflation protection not offered by the other nominal bonds. US Treasury issues TIPS Treasury Inflation-Protected Securities.

A Treasury note quoted at 10230 and a corporate bond quoted at 9945 and a municipal bond quoted at 10245. Banks and pension funds play major role in financial markets.

Treasury Inflation Protected Securities Tips An Introduction

Tips On Tips Treasury Inflation Protected Securities Seeking Alpha

What Are Treasury Inflation Protected Securities How Do They Work Thestreet

Treasury Inflation Protected Securities Tips Define Feature Pros Cons

0 Comments